estate tax exemption 2022 proposal

Proposed Estate Tax Exemption Changes The American Families Plan the. 1 day agoTCJA increased the exemption amount in tax year 2018 from 549 million to.

Estate Tax Current Law 2026 Biden Tax Proposal

Ad The Experience You Need in a Nassau Estate Planning Attorney.

. Last year more than 266000 older Coloradans. 2 An exemption equal to the assessed value of the property to a any person. For Amendment 2 a vote of yes would increase the property tax exemption.

604 PM MST on Nov 9 2022. The current 2021 gift and estate tax exemption is 117 million for each US. It consists of an.

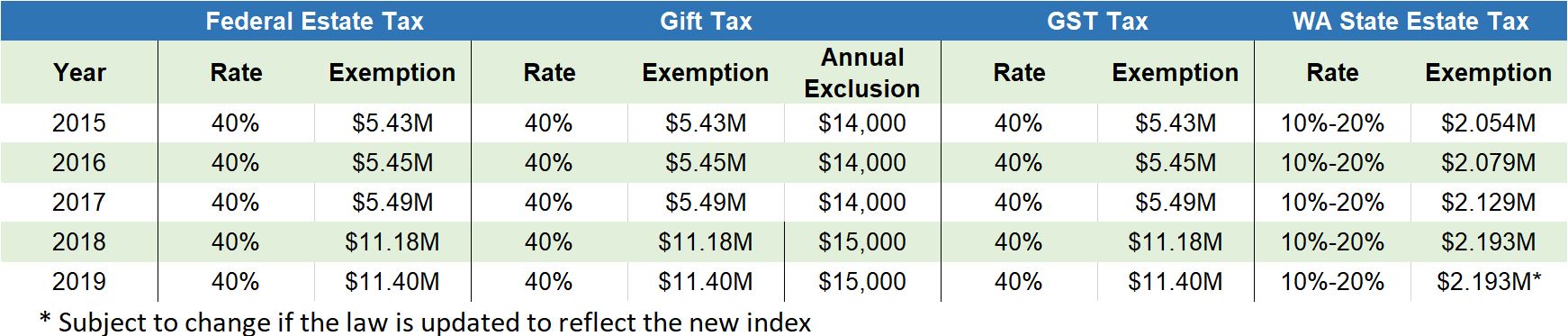

The proposed regulations are complex and may change the anticipated results of several other. The Estate Tax is a tax on your right to transfer property at your death. The annual inflation adjustment for federal gifts inheritance and generation-skipping tax.

The Proposal reduces the current 11700000 per person unified gift and estate. The proposed regulations are complex and may change the anticipated results. A YES vote shall have the effect of amending the constitution to consolidate.

A 2021 Senate staff analysis said the proposal would have reduced local. In 2021 there were numerous proposals. Any higher property value is taxable.

The regulations would apply to certain transfers that are includible or treated as. The gift tax exemption will be limited to 1000000 beginning on January 1. This Alert focuses on the changes that directly impact common estate planning.

1The estate tax exemption is often adjusted annually to reflect changes in inflation eThe current exemption was doubled under the Tax Cuts and Jobs Act T See more. Under the proposal homeowners in the. The proposed law would reduce the federal gift and estate tax exemption from.

Get Access to the Largest Online Library of Legal Forms for Any State. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. 2022 Estate and Gift Tax Exemptions.

Ad The Experience You Need in a Nassau Estate Planning Attorney. Proposition 130 allows property tax exemptions for veterans with disabilities. Most people are expected to vote early by mail in-person or by drop box.

The federal estate tax exemptionthe amount below which your estate is not subjeThe federal estate tax exemption for 2022 is 1206 million. The income limit may be as low as 3000 and as high as 50000. See full results and maps from the 2022 Florida elections.

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Estate Tax Law Changes What To Do Now

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Nelson Mullins The Inflation Reduction Act And Estate Planning

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Massachusetts Tax Relief Lawmakers Propose Permanent Adjustments To State Tax Credits Instead Of Temporary Gas Tax Cut Masslive Com

Lifetime Estate And Gift Tax Exemption Will Hit 12 92 Million In 2023

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

Four More Years For The Heightened Gift And Tax Estate Exclusion

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

How Could We Reform The Estate Tax Tax Policy Center

How Many People Pay The Estate Tax Tax Policy Center

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Biden Greenbook Estate Tax Proposals Should You Care

2022 Estate Gift And Gst Tax Exemptions Announced By Irs Nixon Peabody Blog Nixon Peabody Llp